Fiscal Fourth Quarter Results

For its fiscal fourth quarter 2022 results, Air Products reported GAAP EPS from continuing operations of $2.56, up two percent over prior year, which includes a negative impact of $0.32 for the loss on the Russia business divestiture and the impairment of two equity affiliates in the Asia segment. GAAP net income of $593 million was down four percent over prior year as higher volumes, pricing, and equity affiliates' income were more than offset by higher costs, including the loss on the Russia business divestiture and the equity affiliate impairment, and unfavorable currency due to the strengthening of the U.S. dollar. GAAP net income margin of 16.6 percent decreased 520 basis points, which included a negative impact of about 250 basis points from higher energy cost pass-through.

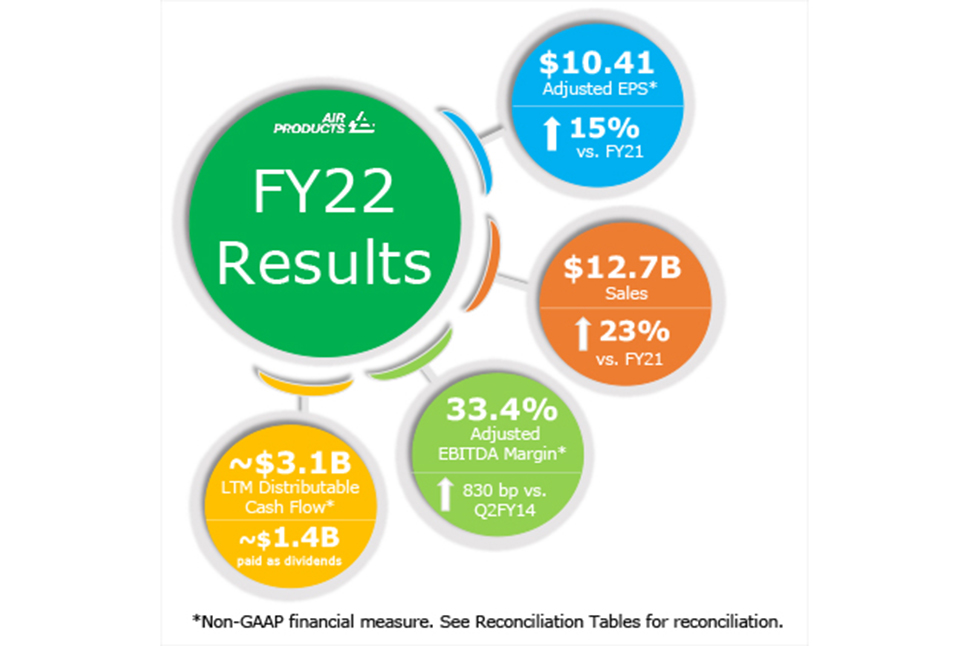

For the quarter, on a non-GAAP basis, adjusted EPS from continuing operations of $2.89 increased 15 percent over the prior year. Adjusted EBITDA of $1,145 million was up 10 percent over the prior year, as higher volumes, pricing and equity affiliates' income more than offset higher costs as well as unfavorable currency due to the strengthening of the U.S. dollar. Adjusted EBITDA margin of 32.1 percent decreased 450 basis points, which included a negative impact of about 450 basis points from higher energy cost pass-through.

Fourth quarter sales of $3.6 billion increased 26 percent over the prior year on 15 percent higher energy cost pass-through, nine percent higher volumes, and eight percent higher pricing, partially offset by six percent unfavorable currency. Volume growth, primarily in Asia and the Americas, was driven by new plants, recovery in hydrogen and better merchant demand. Pricing improved in the three largest regional segments.

Commenting on the results, Air Products' Chairman, President and Chief Executive Officer Seifi Ghasemi said, "Working together, the Air Products team delivered higher volume and pricing in our base industrial gas business while investing in and executing world-class projects to drive the energy transition forward. Despite significant macroeconomic challenges, our people stayed focused and agile, serving our customers and demonstrating a bold commitment to make a cleaner, better future a reality. These results demonstrate the ability of Air Products to deliver strong near-term results while pursuing our longer-term growth strategy. "

Fiscal Fourth Quarter Results by Business Segment

- Americas sales of $1,542 million were up 38 percent over the prior year on 19 percent higher energy cost pass-through, 12 percent higher volumes, and eight percent higher pricing, partially offset by one percent unfavorable currency. Operating income of $333 million increased 15 percent and adjusted EBITDA of $515 million increased eight percent, in each case due to the higher pricing and higher volumes, partially offset by higher costs. Adjusted EBITDA also reflects lower equity affiliates' income. Operating margin of 21.6 percent decreased 440 basis points and adjusted EBITDA margin of 33.4 percent decreased 930 basis points, each of which included a negative impact from energy cost pass-through of about 400 basis points and about 650 basis points, respectively.

- Asia sales of $860 million increased 14 percent over the prior year on 16 percent higher volumes, three percent higher pricing, and two percent higher energy cost pass-through, partially offset by seven percent unfavorable currency. Operating income of $263 million increased 28 percent and adjusted EBITDA of $373 million increased 13 percent, in each case due to the favorable volumes and pricing, which were partially offset by higher costs and unfavorable currency. Operating margin of 30.6 percent increased 330 basis points while adjusted EBITDA margin of 43.3 percent decreased 50 basis points.

- Europe sales of $864 million increased 34 percent over the prior year on 30 percent higher energy cost pass-through and 19 percent higher pricing across all product lines and sub-regions, partially offset by 15 percent unfavorable currency. Volumes were stable despite the challenging economic environment. Operating income of $150 million increased 20 percent and adjusted EBITDA of $217 million increased eight percent, in each case primarily driven by higher pricing, which was partially offset by unfavorable currency and higher costs. Operating margin of 17.4 percent decreased 200 basis points and adjusted EBITDA margin of 25.1 percent decreased 600 basis points, each of which included a negative impact from energy cost pass-through of about 450 basis points and about 750 basis points, respectively.

- Middle East and India equity affiliates' income of $63 million was up $41 million over the prior year, primarily from the Jazan joint venture.

- Corporate and other sales of $263 million decreased 12 percent compared to the prior year, driven by lower sale of equipment activity.

Outlook

Effective beginning in the first quarter of fiscal year 2023, management will review adjusted earnings per share excluding the impact of non-service related components of the net periodic benefit/cost for our defined benefit pension plans. Air Products expects full-year fiscal 2023 adjusted EPS guidance of $11.20 to $11.50, up nine to 12 percent over prior year adjusted EPS. For the fiscal 2023 first quarter, Air Products' adjusted EPS guidance is $2.60 to $2.80, up five to 13 percent over fiscal 2022 first quarter adjusted EPS. The projected percentage increase in adjusted EPS for full year fiscal 2023 and fiscal 2023 first quarter is calculated using adjusted fiscal 2022 results in order to present this information on a consistent basis using the calculation of adjusted EPS that will be applied in fiscal year 2023. Refer to the reconciliations of GAAP to non-GAAP historical results below for additional information.

Air Products expects capital expenditures of $5.0 - $5.5 billion for full-year fiscal 2023.

Management has provided adjusted EPS guidance on a continuing operations basis, which excludes the impact of certain items that we believe are not representative of our underlying business performance, such as the incurrence of additional costs for cost reduction actions and impairment charges, or the recognition of gains or losses on disclosed items. It is not possible, without unreasonable efforts, to predict the timing or occurrence of these events or the potential for other transactions that may impact future GAAP EPS or the effective tax rate. Similarly, it is not possible, without unreasonable efforts, to reconcile our forecasted capital expenditures to future cash used for investing activities because we are unable to identify the timing or occurrence of our future investment activity, which is driven by our assessment of competing opportunities at the time we enter into transactions. Furthermore, it is not possible to identify the potential significance of these events in advance, but any of these events, if they were to occur, could have a significant effect on our future GAAP results. Management therefore is unable to reconcile, without unreasonable effort, the Company’s forecasted range of adjusted EPS, the effective tax rate and our capital expenditures to a comparable GAAP range.

Earnings Teleconference

Access the fiscal 2022 fourth quarter earnings teleconference scheduled for 8:30 a.m. Eastern Time on November 3, 2022 by calling 323-794-2093 and entering passcode 7733307 or by accessing the Event Details page on Air Products’ Investor Relations website.